Increasing valuations at exit through efficient growth

We combine strategic advisory and execution to help growth-stage B2B SaaS and tech-enabled services companies achieve efficient, high-value growth at any stage of maturity

Deep operations and private equity experience to quickly achieve results

At Exit Point Partners, we bring a unique blend of advisory expertise and hands-on execution to support growth-stage B2B SaaS and tech-enabled services companies in achieving their full potential. We believe in the power of data to drive decision making, whether that is in day-to-day operations or your most strategic choices.

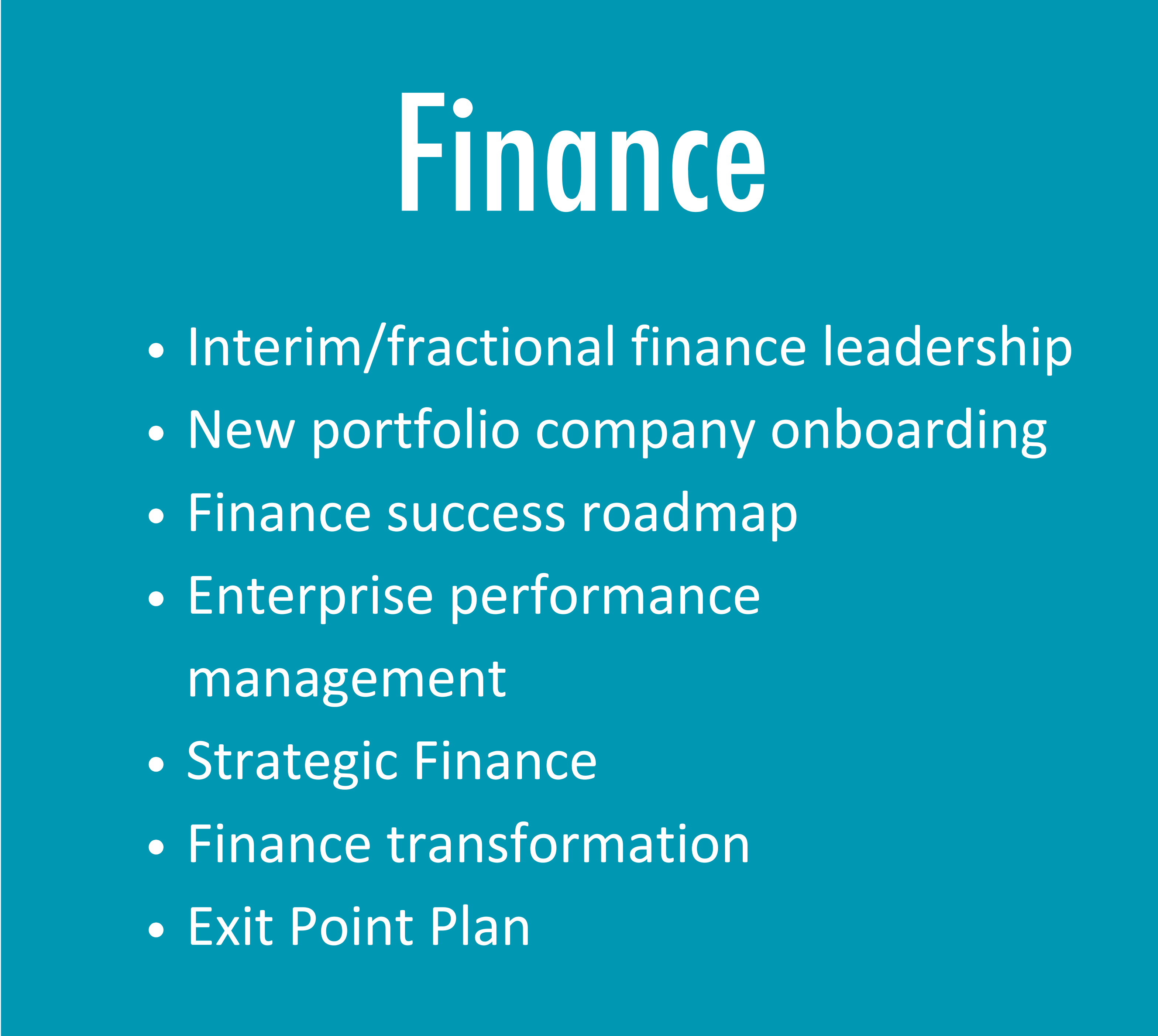

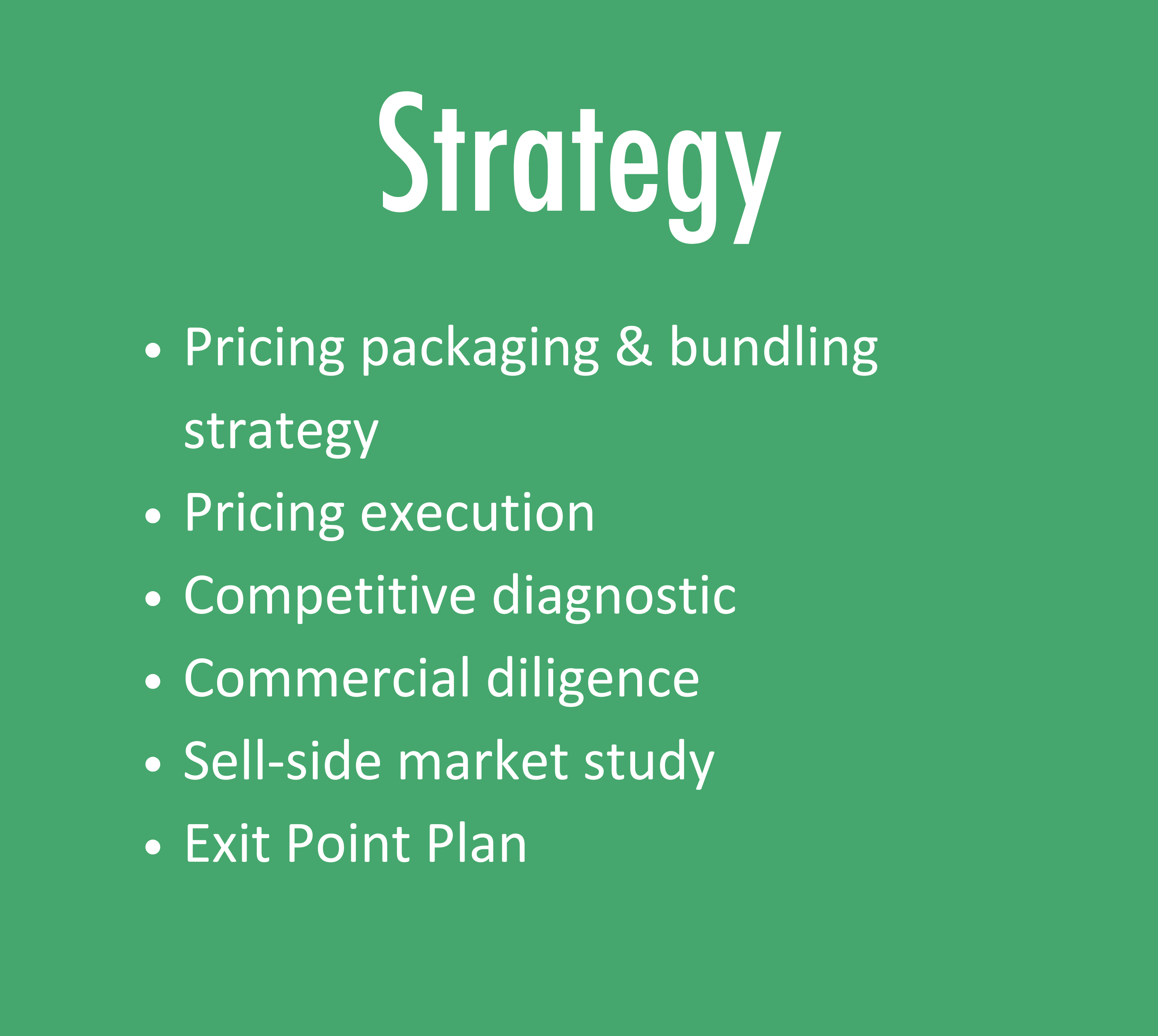

Whether you’re looking to establish finance as a key enabler for your organization, optimize your pricing and packaging, refining your competitive positioning, or preparing for a major milestone like an acquisition or an exit, our team has the depth of experience and insights to meet you where you are in your growth journey.

Our Expertise & Services